summit county utah sales tax rate

Wayfair Inc affect Utah. Click any locality for a full breakdown of local property taxes or visit our Utah sales tax calculator to lookup local rates by zip code.

Suicide Rate In Summit County Reaching Record Levels Summitdaily Com

You may contact the Summit County Auditors Office.

. Summit County has one of the highest median property taxes in the United States and is ranked 497th of the 3143 counties in order of median property taxes. Look up 2022 sales tax rates for Summit Utah and surrounding areas. The median property tax in Summit County Utah is 1921 per year for a home worth the median value of 492100.

274 rows 696 Utah has state sales tax of 485 and allows local governments to collect a local option sales tax of up to 335. The December 2020 total local sales tax rate was also 7150. E-checks are free credit cards 265 convenience fee.

This is the total of state county and city sales tax rates. Summit County in Utah has a tax rate of 655 for 2022 this includes the Utah Sales Tax Rate of 595 and Local Sales Tax Rates in Summit County totaling 06. 31 rows Utah UT Sales Tax Rates by City Utah UT Sales Tax Rates by City The state sales tax rate in Utah is 4850.

Local tax rates in Utah range from 0 to 4 making the sales tax range in Utah 47 to 87. To review the rules in Ohio visit our state-by-state guide. The Summit Park sales tax rate is.

59-2-501 - 59-2-515. With local taxes the total sales tax rate is between 6100 and 9050. The Summit County Sales Tax is 155 A county-wide sales tax rate of 155 is applicable to localities in Summit County in addition to the 485 Utah sales tax.

1 Penalty on Unpaid Taxes. Manage Summit County Funds. Some cities and local governments in Summit County collect additional local sales taxes which can be.

There are a total of 131 local tax jurisdictions across the state collecting an average local tax of 211. The Utah state sales tax rate is currently. Get rates tables What is the sales tax rate in Summit Park Utah.

Unsold Properties Any property unsold at the Tax Sale which is not in the public interest to be recertified to a subsequent sale shall become county property. Final Deadline for 2022 Tax Relief Applications. Summit County UT Sales Tax Rate The current total local sales tax rate in Summit County UT is 7150.

The County sales tax rate is. Summit County in Ohio has a tax rate of 675 for 2022 this includes the Ohio Sales Tax Rate of 575 and Local Sales Tax Rates in Summit County totaling 1. The 2018 United States Supreme Court decision in South Dakota v.

The December 2020 total local sales tax rate was also 6100. Monthly charge per telephone line. The minimum combined 2022 sales tax rate for Summit Park Utah is.

The Treasurer is responsible for the banking reconciliation management and investment of all Summit County funds. Any parcel offered for sale may be subject to a roll-back tax under the provisions of The Farmlands Assessment Act of 1969 UCA. This is the total of state and county sales tax rates.

2022 Utah Sales Tax By County. The tax rate is determined by all the taxing agencies-city or county school districts and others-and depends on what is needed to provide all the services you enjoy. Summit is in the following zip codes.

Michael Howard Summit County Auditor Contact Us Michael Howard Auditor Email Michael Howard Phone. Summit UT Sales Tax Rate The current total local sales tax rate in Summit UT is 6100. If you would like information on property owned by Summit County.

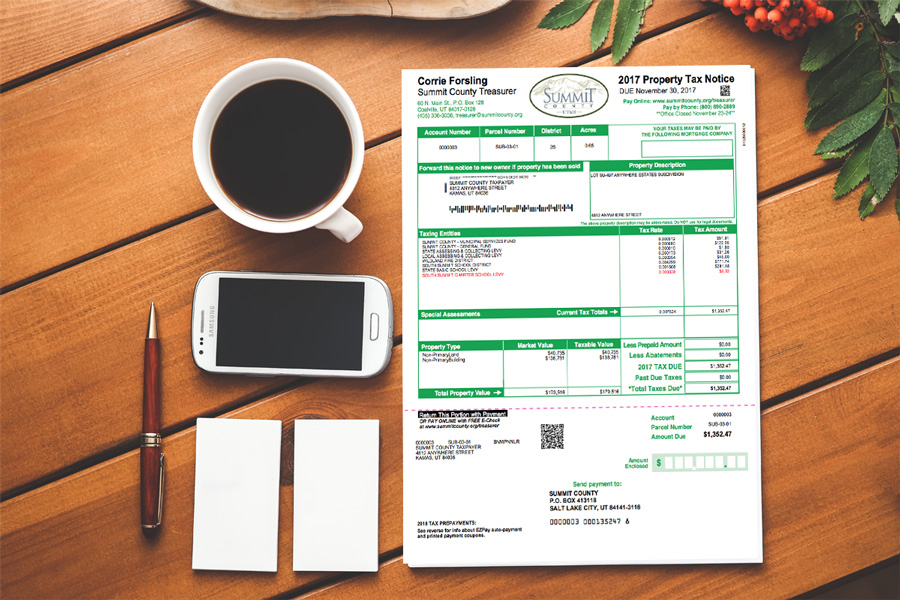

The 2018 United States Supreme Court decision in South Dakota v. Find your Utah combined state and local tax rate. PAY BY MAIL Make your check payable to Summit County Treasurer Postmark by November 30 and mail to.

Tax rates are provided by Avalara and updated monthly. The Summit County Utah sales tax is 655 consisting of 470 Utah state sales tax and 185 Summit County local sales taxesThe local sales tax consists of a 135 county sales tax and a 050 special district sales tax used to fund transportation districts local attractions etc. 21810 for a 20000 purchase Park City UT 905 sales tax in Summit County 21220 for a 20000 purchase Tremonton UT 61 sales tax in Box Elder County You can use our Utah sales tax calculator to determine the applicable sales tax for any location in Utah by entering the zip code in which the purchase takes place.

Summit County uses Park City as the mailing city and is generally ZIP Code 84098. Combined sales and use tax rate from the previous section. Summit County Treasurer Lockbox 413118 PO Box 35147 Seattle WA 98124-5147 Yes Seattle is correct.

You can find more tax rates and allowances for Summit County and Ohio in the 2022 Ohio Tax Tables. The Summit County sales tax rate is. Select the Utah city from the list of popular cities below to see its current sales tax rate.

91 rows The Combined Sales and Use Tax Rates chart shows taxes due on all transactions subject to sales and use tax and includes. Utah has recent rate changes Thu Jul 01 2021. Click here for a larger sales tax map or here for a sales tax table.

Sales Tax Breakdown Summit Details Summit UT is in Iron County. The Utah sales tax rate is currently. Summit County collects on average 039 of a propertys assessed fair market value as property tax.

Did South Dakota v. Utah sales tax rates vary depending on which county and city youre in which can make finding the right sales tax rate a headache. The base state sales tax rate in Utah is 485.

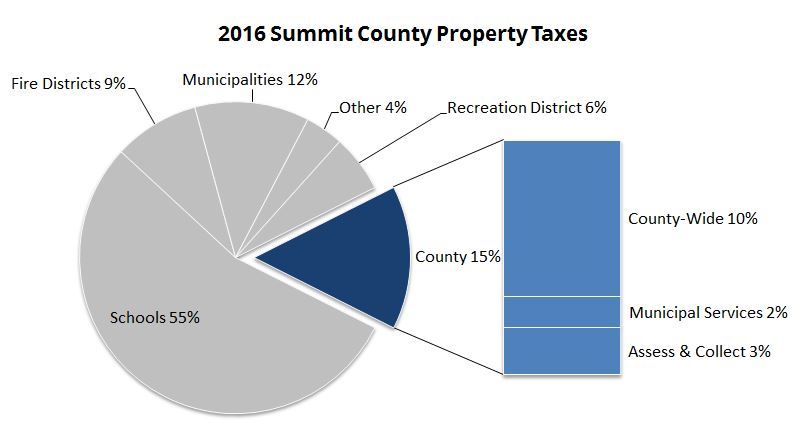

Has impacted many state nexus laws and sales tax collection requirements. The amount of taxes you pay is determined by a tax rate applied to your propertys assessed value. How Does Sales Tax in Summit County compare to the rest of Ohio.

Due Date for 2022 taxes to avoid additional penalties interest. The minimum combined 2022 sales tax rate for Summit County Utah is. The entire combined rate is due on all taxable transactions in that tax jurisdiction.

UTAH CODE TITLE 59 CHAPTER 12 SALES USE TAX ACT OTHER SALES TAX RATES AND FEES. Box 128 Coalville UT 84017 Staff Directory. What is the sales tax rate in Summit County.

If the tax is passed on to the consumer the tax is included in the taxable. State Local Option Mass Transit Rural Hospital Arts Zoo Highway County Option Town Option and Resort taxes. The Summit County sales tax rate is.

You can find more tax rates and allowances for Summit County and Utah in the 2022 Utah Tax Tables.

Here S What You Need To Know To Vote In The May 3 Primary Election In Summit County

Your 2018 Summit County Utah Property Taxes Explained Park City Real Estate Agent Nancy Tallman

How Healthy Is Summit County Utah Us News Healthiest Communities

The Most Democratic Counties In Utah The Times Independent

Colorado Summit County Tourism Industries Face Long Hard Road To Recovery Summitdaily Com

Summit County Can T Lower Property Taxes For Owners Who Rent Long Term To Locals Summitdaily Com

Summit County Treasurer S Office Mails Property Tax Notices Summitdaily Com

Wasatch Summit County Property Taxes How They Work Park City Real Estate Agent Nancy Tallman

Your 2018 Summit County Utah Property Taxes Explained Park City Real Estate Agent Nancy Tallman

Summit County Short Term Rental Restrictions

In Summit County Vacation Rentals Often But Not Always More Profitable Than Long Term Leasing Summitdaily Com

Nevada Becomes 10th State To Ditch Tampon Tax Tampon Tax Tampons Nevada

Experts Provide Skier And Snowboarder Safety Tips After 4 Deaths Occur In Summit County Within A One Month Time Frame Vaildaily Com

Suspect Evades Police Enters Home Where Family Was Sleeping

Summit County Utah Republican Party

Property Taxes When To Consider An Appeal Choose Park City Real Estate